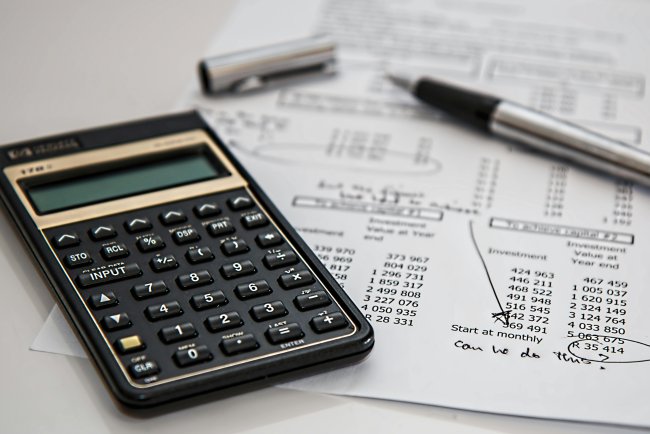

Impact of Tax Policies on Financial Reporting

This article explores the impact of tax policies on financial reporting, highlighting how changes in tax laws—such as GST, corporate tax rates, and deferred tax rules—affect a company’s income statements, balance sheets, and disclosures. It emphasizes the growing importance of aligning accounting practices with regulatory changes like Ind AS and IFRS, while staying compliant with SEBI and audit guidelines. The post also promotes practical tax and accounting courses from ReadyAccountant.com, helping professionals upgrade their skills in deferred tax, GST compliance, corporate reporting, and financial statement planning in line with the latest reforms expected in 2025.

In any business, tax policies have a big impact on how financial information is shared. The impact of tax policies on financial reporting can be seen in profit and loss reports, balance sheets, and how companies show their income and expenses. As tax rules change over time, companies must also update their accounting methods to follow the law and maintain clarity in reporting.

1. Tax Policy and Accounting Standards

Tax policies are not just legal rules; they also help guide how businesses prepare their accounting reports. When tax policy and accounting standards work together, companies can share a correct and clear picture of their finances. India now follows Ind AS (Indian Accounting Standards) and is moving closer to IFRS (International Financial Reporting Standards). This means companies need to report taxes in a more detailed way.

2. Financial Reporting Under New Tax Laws

New tax laws have changed how companies report their finances. For example, the Goods and Services Tax (GST) forced companies to change how they manage indirect taxes. Changes in corporate tax rates and tax rules also impact how income, costs, and profits are recorded in company books. This is the financial reporting under new tax laws.

3. Effect of Tax Regulations on Corporate Reporting

When new tax laws are introduced, businesses must change how they record their income and expenses. This affects corporate reporting, such as how deferred tax is calculated, which expense categories are used, and how long-term plans are managed. Regular updates in company accounting policies are necessary to match these new tax rules.

4. Tax Accounting Changes in 2025

India will soon implement more tax accounting changes in 2025. These changes include:

-

Better tracking of invoices through e-invoicing

-

Stricter audit rules

-

Fully digital tax reporting

Companies will have to adjust their financial systems and reporting practices to stay compliant.

5. Financial Disclosures and Taxation

Financial disclosures show how much tax a company has paid or still owes. These details help investors, auditors, and government agencies understand the company’s taxation status. Honest and clear disclosures build trust and ensure that a company is following tax laws.

6. Income Tax Impact on Financial Statements

Income tax affects different parts of a company's financial reports. Businesses must:

-

Report current tax (taxes due now)

-

Report deferred tax (taxes owed in the future)

-

Match their reported income with their taxable income

These steps help the company plan better and stay legally safe.

7. Tax Implications for IFRS Reporting

Under IFRS reporting, taxes are treated differently from Indian standards. Companies need to account for deferred tax assets and liabilities carefully. These are future amounts of tax that will either be paid or saved. Proper planning and record-keeping are needed to handle the tax implications for IFRS reporting.

8. Corporate Tax and Balance Sheet Impact

Changes in corporate tax laws can directly affect a company’s balance sheet. A lower tax rate may increase profits and savings. A higher tax rate might raise liabilities. These changes also affect investor decisions, especially when reviewing a company's financial strength.

9. How Tax Policies Affect Income Statements

Tax policy changes can affect a company’s income statement. For example, new rules on depreciation (how asset value decreases over time) can change how much profit is shown. This also affects earnings per share (EPS) and investor returns.

10. Role of Taxation in Financial Accounting

Taxation is a key part of financial accounting. Companies need to plan for tax payments, follow tax laws, and report them accurately. Tax also influences business decisions like investments and pricing.

11. GAAP vs IFRS Tax Treatment

Some companies use GAAP (common in the U.S.), while others use IFRS. These systems handle taxes differently. This creates confusion, especially for multinational companies that need to prepare reports in both formats.

12. Deferred Tax Assets and Liabilities

If a company pays more or less tax now and plans to adjust it in the future, it creates deferred tax assets (future tax savings) or liabilities (future payments). Managing them properly helps with smart financial planning.

13. Tax Compliance and Financial Audits

Being tax compliant means a company is following all current tax laws. This makes it easier to pass a financial audit. Good recordkeeping, correct tax filings, and timely payments help avoid penalties and win investor trust.

14. Impact of GST on Company Accounts

The impact of GST on company accounts is huge. It affects:

-

How and when revenue is reported

-

Input tax credits (tax refunds on purchases)

-

Tax reporting across different states

Companies must ensure their accounting software and processes are GST-compliant.

15. Tax Reforms and Accounting Practices

Each tax reform means that companies need to update their accounting practices. This may include retraining employees, upgrading software, or rewriting company policies. Ignoring changes can lead to mistakes and legal troubles.

16. SEBI Guidelines and Financial Disclosures

SEBI (Securities and Exchange Board of India) requires listed companies to disclose any major tax impact. This ensures transparency so shareholders are not misled about profits or losses caused by tax changes.

17. Ind AS Tax Adjustments

When following Ind AS, companies need to make several tax adjustments, such as:

-

Handling revenue differently

-

Using fair value for assets

-

Making lease-related tax entries

These changes affect how a company reports taxes and deferred tax items.

18. Tax Planning Through Financial Statements

Companies use financial statements to plan for taxes smartly. Legal and ethical tax planning helps reduce tax bills and increase savings. This includes making use of deductions, provisions, and special tax benefits, all shown in reports.

Upgrade Your Career with In-Demand Tax & Accounting Skills

Explore our top programs to become industry-ready:

-

Best Accounting Course on Taxation

-

Learn Deferred Tax Accounting in India

-

Financial Reporting Certification with Tax Focus

-

Advanced Tax and Financial Reporting Training

-

Accounting for Tax Law Changes 2025

- SAP FICO (Finance & Controlling)

-

Tax Treatment under Indian Accounting Standards

-

Online Course in Corporate Tax Reporting

Conclusion

The impact of tax policies on financial reporting continues to grow in complexity and importance. From GST reforms to upcoming tax changes in 2025, businesses must stay agile. Through proper training and practical knowledge, you can ensure your company or career is compliant, future-ready, and financially strong.

What's Your Reaction?