This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Find out more here

Top 15 Advanced Income Tax Questions and Answers

The blog “Top 15 Advanced Income Tax Questions and Answers” explains important concepts that help accountants, tax professionals, ...

Corporate Accounting vs Traditional Accounting: Ke...

Corporate Accounting vs Traditional Accounting: Key Differences highlights how accounting practices are evolving in today’s digita...

Best Places to Learn Tax in Kolkata

Ready Accountant is widely regarded as one of the best places to learn tax in Kolkata, particularly for mastering Taxation (Income...

Top Income Tax Changes Introduced in Budget 2026

The Budget 2026 income tax changes introduced several updates aimed at simplifying India’s taxation system and providing relief to...

Grow Your Career as a Certified Corporate Accounta...

In today’s competitive business world, accountants must go beyond basic bookkeeping and develop skills in corporate accounting, GS...

Iran America War Effects in India (2026): Economic...

The Iran-American war effects in India are mainly seen through rising oil prices, inflation, and economic uncertainty. Since India...

Top 7 Skills Every Accountant Must Learn in 2026

In 2026, accountants need more than basic accounting knowledge to succeed. They must learn practical skills like Taxation (Income ...

Tax Evasion & Cash Transaction Rules in 2026: Late...

The Income Tax Cash Rules 2026 impose strict limits on cash transactions to curb tax evasion and promote transparency. Under the C...

Ultimate Guide to Financial Statements of Companie...

Financial Statements of Companies provide a clear overview of a business’s financial health and performance. The main types of fin...

How Accounting Certification Helps You Get Faster ...

Accounting certifications help you get jobs faster because they focus on practical, job-ready skills instead of only theory. In co...

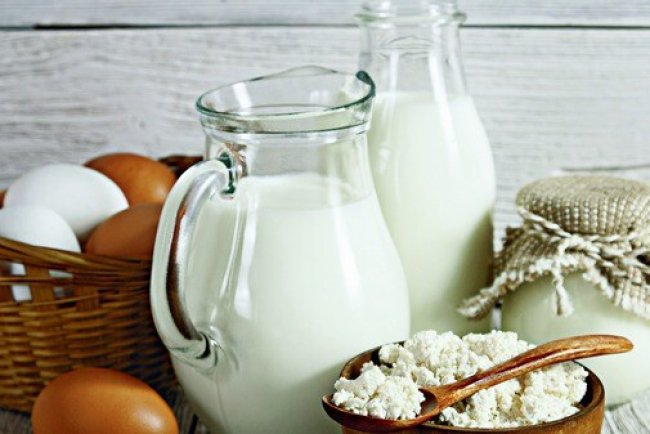

GST on Milk and Dairy Products – GST Rate

GST on milk and dairy products varies depending on the type and level of processing. The GST rate on milk in India is generally 0%...

Why Most Students Prefer ReadyAccountant in Kolkat...

ReadyAccountant has become a preferred choice for students in Kolkata because it focuses on practical, job-oriented accounting tra...

Advanced Excel for Accountants: Must-Know Function...

Advanced Excel skills are essential for modern accountants to improve accuracy, efficiency, and financial reporting capabilities. ...

Top 30 Accounting Interview Questions and Answers

Gemini said Stop settling for "we’ll get back to you." Our Top 30 Accounting Interview Questions and Answers guide bridges the ga...

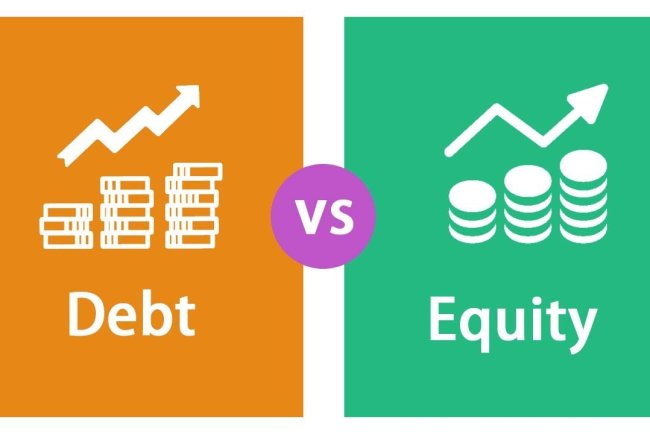

Equity vs Debt Funding: Pros and Cons

Understanding Equity vs debt funding is essential for making smart business financing decisions. Equity funding involves raising c...

Master the Compliance Ecosystem GST, TDS, ROC, and...

Master the compliance ecosystem with Ready Accountant’s Certified Corporate Accounting (CCA) course, designed to bridge the gap be...

Indian Tax System Structure and Reforms:

The Indian tax system structure is divided into direct and indirect taxes, administered by the central and state governments under...

Mixed Supply & Composite Supply under GST

Mixed Supply and Composite Supply under GST are important concepts under the Goods and Services Tax. A Composite Supply consists o...

ERP Implementation Timeline Creation(2026)

ERP Implementation Timeline Creation(2026) is essential for businesses aiming to successfully adopt modern ERP systems and streaml...

ITR Filing Last Date for AY 2026–27: Complete Guid...

The ITR filing last date for AY 2026–27 is expected to be July 31, 2026 for individuals and non-audit taxpayers, with later deadli...

Struggling to Stand Out in Corporate Finance?

Many professionals today are struggling to stand out in corporate finance due to the growing demand for practical skills beyond ba...

Differences Between Tally Prime vs Tally ERP 9

Tally Prime is a powerful upgrade from Tally ERP 9, offering a modern interface, faster navigation, and improved multitasking for ...

India’s Budget 2026 Allocation for the Employment-...

Budget 2026 allocates ₹30,000+ crore to the Employment-Linked Incentive Scheme (ELIS) to boost job creation, support MSME hiring, ...

From Fresher to Professional: Complete Accountant ...

This blog outlines a complete accountant training roadmap for freshers who want to build a successful career in accounting. It exp...

50 Important Cash Book Questions & Answers For Int...

This blog covers 50 important cash book interview questions and answers to help accounting students and job seekers prepare effect...

How to Get Placed as an Accountant After Graduatio...

To understand how to get placed as an accountant after graduation, students must combine their degree with practical skills in Tal...

Top Accounting Skills You Need in 2026 to Get Hire...

To get hired faster in 2026, accountants need more than just a degree—they need practical, job-ready skills. Strong fundamentals i...

How Ready Accountant Makes You Job-Ready in 3–6 Mo...

Ready Accountant helps students become job-ready in just 3–6 months through practical, industry-focused training. Its Certified Co...

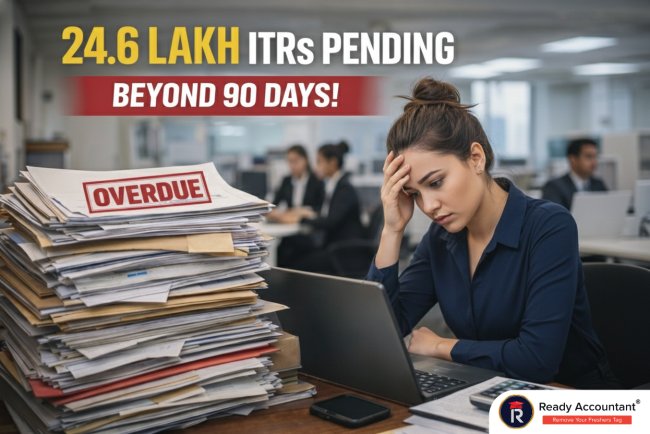

24.6 Lakh ITRs Pending Beyond 90 Days

The backlog of 24.6 lakh ITRs pending beyond 90 days reflects the growing pressure on India’s tax system due to higher return fili...

60 Important Depreciation Questions & Answers For ...

Depreciation is the systematic allocation of a fixed asset’s cost (minus residual value) over its useful life. It is a non-cash ex...

AIS & Form 26AS Explained: Why They Matter for ITR...

AIS (Annual Information Statement) and Form 26AS are essential documents for accurate ITR filing in India. AIS provides a detailed...

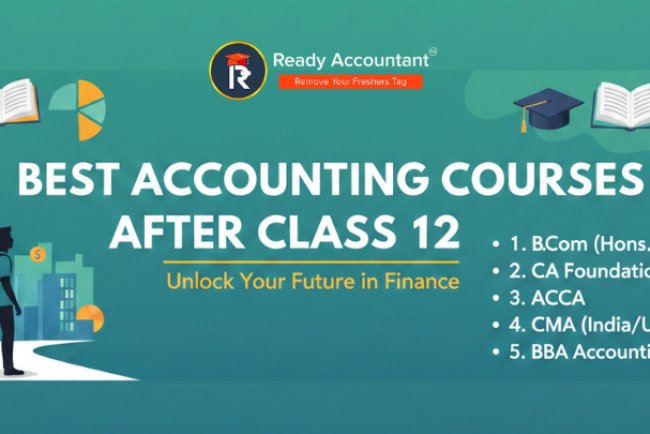

Best Accounting Courses After Class 12

Choosing the Best Accounting Courses After Class 12 can open the door to a stable and high-growth career. From traditional options...

Top Tax Saving Strategies for Salaried Employees i...

Salaried employees in 2026 can reduce their tax burden by choosing the right tax regime, maximizing Section 80C deductions, and in...

Complete Guide to Deleting a Company in TallyPrime

This Complete Guide to Deleting a Company in TallyPrime explains how to safely and permanently remove unwanted company data from T...

How to Check Your IRS Tax Refund Status (Step-by-S...

An Accounting, Taxation, and GST course equips students with practical skills needed for modern finance and compliance roles. It c...

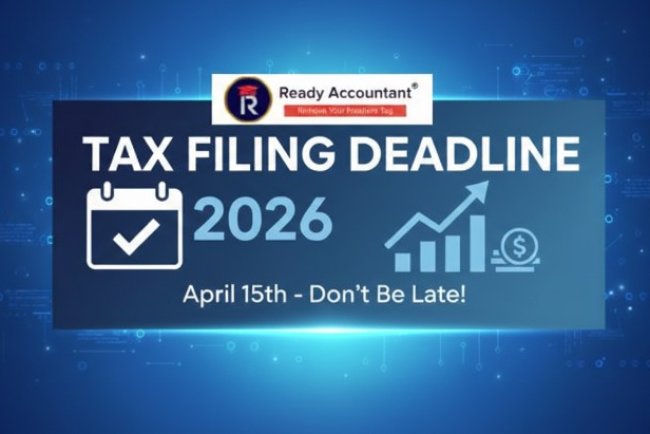

Tax Filing Deadline in 2026

The Tax Filing Deadline 2026 outlines key compliance dates for FY 2025-26 (AY 2026-27) following updates in Budget 2026. Salaried ...

Career Opportunities After 12th Commerce: Complete...

Career opportunities after 12th commerce are vast and diverse, ranging from traditional degrees to skill-based professional course...

Latest RBI Interest Rates Explained (Repo to Rever...

RBI interest rates play a crucial role in guiding India’s economy by controlling inflation, managing liquidity, and supporting eco...

A Complete Guide to Tax Excel Utility for AY 2025-...

The Income Tax Excel Utility is a free, offline tool provided by the Income Tax Department to help taxpayers file their ITR forms ...

Easy Guide to Understanding Groups in Tally Prime

Groups in Tally Prime classify ledgers with similar purposes, making accounting, GST, and tax reporting easier. With 28 default gr...

Major Differences Between TDS and TCS

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are key mechanisms in Indian taxation, differing in application and...

Excel Lookup and Reference Functions: A Step-By-St...

Excel lookup and reference functions help users quickly find and manage data in spreadsheets. Functions like VLOOKUP, HLOOKUP, XLO...

Real-world Applications: How Corporate Accounting ...

Accounting certification courses offer professional In-Class hands-on training based on corporate needs with upgraded technology l...

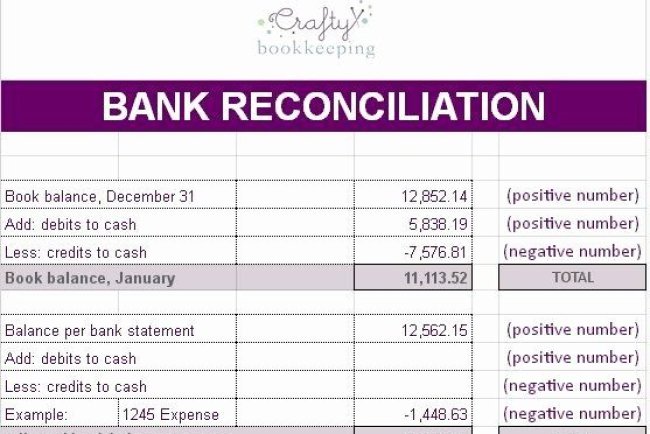

25 Important BRS Questions For Interview Preparati...

This blog covers the 25 most important Bank Reconciliation Statement (BRS) interview questions to help accounting students and job...

Why Certified Corporate Accounting Is in High Dema...

Why Certified Corporate Accounting Is in High Demand comes down to industry needs for job-ready professionals with practical skill...

Top 25 Accounting Interview Questions and Answers ...

This guide on Top 25 Accounting Interview Questions and Answers 2026 covers essential accounting fundamentals, practical concepts,...

TDS Entry in Tally with Practical Example

This article explains TDS Entry in Tally with Practical Example in a simple and practical way. It covers TDS basics, ledger creati...

Build a Strong Career in Accounting & Taxation

Building a strong career in accounting and taxation offers long-term stability, consistent demand, and diverse job opportunities a...

Budget 2026 Focuses on Maintaining Growth Momentum

Budget 2026 focuses on maintaining growth momentum by balancing fiscal discipline with strategic investments in infrastructure, ma...