This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Find out more here

readyaccountant

Last seen: 2 days ago

Best Places to Learn Tax in Kolkata

Ready Accountant is widely regarded as one of the best places to learn tax in Kolkata, particularly for mastering Taxation (Income...

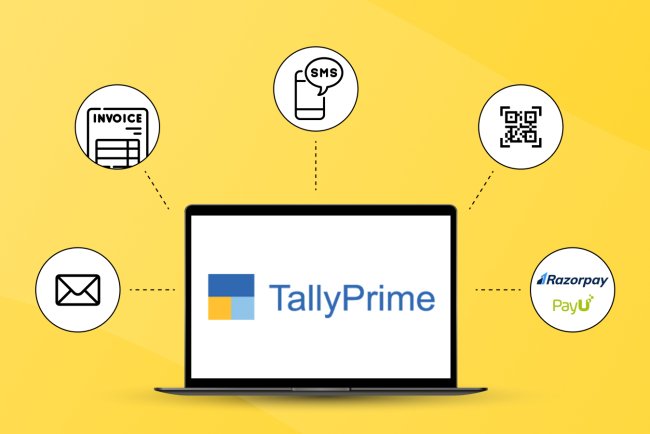

Tally Prime Multi-Godown Guide: Advanced...

The Tally Prime multi-godown feature helps businesses efficiently manage inventory across multiple warehouses or storage locations...

Top 15 Advanced Income Tax Questions and...

The blog “Top 15 Advanced Income Tax Questions and Answers” explains important concepts that help accountants, tax professionals, ...

Corporate Accounting vs Traditional Acco...

Corporate Accounting vs Traditional Accounting: Key Differences highlights how accounting practices are evolving in today’s digita...

Top Income Tax Changes Introduced in Bud...

The Budget 2026 income tax changes introduced several updates aimed at simplifying India’s taxation system and providing relief to...

Grow Your Career as a Certified Corporat...

In today’s competitive business world, accountants must go beyond basic bookkeeping and develop skills in corporate accounting, GS...

Iran America War Effects in India (2026)...

The Iran-American war effects in India are mainly seen through rising oil prices, inflation, and economic uncertainty. Since India...

Top 7 Skills Every Accountant Must Learn...

In 2026, accountants need more than basic accounting knowledge to succeed. They must learn practical skills like Taxation (Income ...

Tax Evasion & Cash Transaction Rules in ...

The Income Tax Cash Rules 2026 impose strict limits on cash transactions to curb tax evasion and promote transparency. Under the C...

Ultimate Guide to Financial Statements o...

Financial Statements of Companies provide a clear overview of a business’s financial health and performance. The main types of fin...

How Accounting Certification Helps You G...

Accounting certifications help you get jobs faster because they focus on practical, job-ready skills instead of only theory. In co...

GST on Milk and Dairy Products – GST Rat...

GST on milk and dairy products varies depending on the type and level of processing. The GST rate on milk in India is generally 0%...

Why Most Students Prefer ReadyAccountant...

ReadyAccountant has become a preferred choice for students in Kolkata because it focuses on practical, job-oriented accounting tra...

Advanced Excel for Accountants: Must-Kno...

Advanced Excel skills are essential for modern accountants to improve accuracy, efficiency, and financial reporting capabilities. ...

Top 30 Accounting Interview Questions an...

Gemini said Stop settling for "we’ll get back to you." Our Top 30 Accounting Interview Questions and Answers guide bridges the ga...

Equity vs Debt Funding: Pros and Cons

Understanding Equity vs debt funding is essential for making smart business financing decisions. Equity funding involves raising c...

Master the Compliance Ecosystem GST, TDS...

Master the compliance ecosystem with Ready Accountant’s Certified Corporate Accounting (CCA) course, designed to bridge the gap be...

Indian Tax System Structure and Reforms:

The Indian tax system structure is divided into direct and indirect taxes, administered by the central and state governments under...

Mixed Supply & Composite Supply under GS...

Mixed Supply and Composite Supply under GST are important concepts under the Goods and Services Tax. A Composite Supply consists o...

ERP Implementation Timeline Creation(202...

ERP Implementation Timeline Creation(2026) is essential for businesses aiming to successfully adopt modern ERP systems and streaml...

ITR Filing Last Date for AY 2026–27: Com...

The ITR filing last date for AY 2026–27 is expected to be July 31, 2026 for individuals and non-audit taxpayers, with later deadli...

Struggling to Stand Out in Corporate Fin...

Many professionals today are struggling to stand out in corporate finance due to the growing demand for practical skills beyond ba...

Differences Between Tally Prime vs Tally...

Tally Prime is a powerful upgrade from Tally ERP 9, offering a modern interface, faster navigation, and improved multitasking for ...

India’s Budget 2026 Allocation for the E...

Budget 2026 allocates ₹30,000+ crore to the Employment-Linked Incentive Scheme (ELIS) to boost job creation, support MSME hiring, ...

From Fresher to Professional: Complete A...

This blog outlines a complete accountant training roadmap for freshers who want to build a successful career in accounting. It exp...

50 Important Cash Book Questions & Answe...

This blog covers 50 important cash book interview questions and answers to help accounting students and job seekers prepare effect...

How to Get Placed as an Accountant After...

To understand how to get placed as an accountant after graduation, students must combine their degree with practical skills in Tal...

Top Accounting Skills You Need in 2026 t...

To get hired faster in 2026, accountants need more than just a degree—they need practical, job-ready skills. Strong fundamentals i...

How Ready Accountant Makes You Job-Ready...

Ready Accountant helps students become job-ready in just 3–6 months through practical, industry-focused training. Its Certified Co...

24.6 Lakh ITRs Pending Beyond 90 Days

The backlog of 24.6 lakh ITRs pending beyond 90 days reflects the growing pressure on India’s tax system due to higher return fili...

60 Important Depreciation Questions & An...

Depreciation is the systematic allocation of a fixed asset’s cost (minus residual value) over its useful life. It is a non-cash ex...

AIS & Form 26AS Explained: Why They Matt...

AIS (Annual Information Statement) and Form 26AS are essential documents for accurate ITR filing in India. AIS provides a detailed...

Best Accounting Courses After Class 12

Choosing the Best Accounting Courses After Class 12 can open the door to a stable and high-growth career. From traditional options...

Top Tax Saving Strategies for Salaried E...

Salaried employees in 2026 can reduce their tax burden by choosing the right tax regime, maximizing Section 80C deductions, and in...

Complete Guide to Deleting a Company in ...

This Complete Guide to Deleting a Company in TallyPrime explains how to safely and permanently remove unwanted company data from T...

How to Check Your IRS Tax Refund Status ...

An Accounting, Taxation, and GST course equips students with practical skills needed for modern finance and compliance roles. It c...

Tax Filing Deadline in 2026

The Tax Filing Deadline 2026 outlines key compliance dates for FY 2025-26 (AY 2026-27) following updates in Budget 2026. Salaried ...

Career Opportunities After 12th Commerce...

Career opportunities after 12th commerce are vast and diverse, ranging from traditional degrees to skill-based professional course...

Latest RBI Interest Rates Explained (Rep...

RBI interest rates play a crucial role in guiding India’s economy by controlling inflation, managing liquidity, and supporting eco...

A Complete Guide to Tax Excel Utility fo...

The Income Tax Excel Utility is a free, offline tool provided by the Income Tax Department to help taxpayers file their ITR forms ...

Easy Guide to Understanding Groups in Ta...

Groups in Tally Prime classify ledgers with similar purposes, making accounting, GST, and tax reporting easier. With 28 default gr...

Major Differences Between TDS and TCS

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are key mechanisms in Indian taxation, differing in application and...

Excel Lookup and Reference Functions: A ...

Excel lookup and reference functions help users quickly find and manage data in spreadsheets. Functions like VLOOKUP, HLOOKUP, XLO...

Real-world Applications: How Corporate A...

Accounting certification courses offer professional In-Class hands-on training based on corporate needs with upgraded technology l...

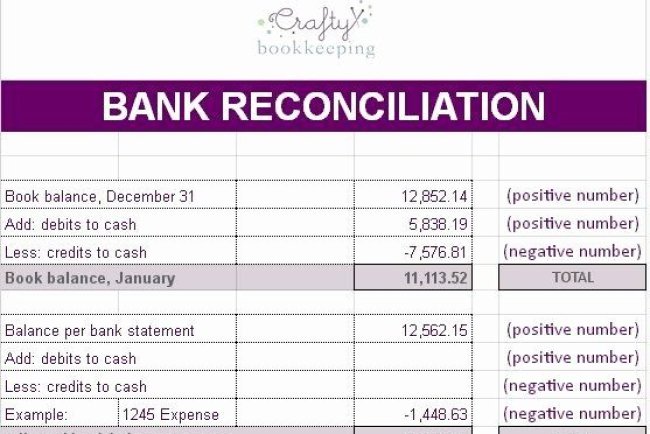

25 Important BRS Questions For Interview...

This blog covers the 25 most important Bank Reconciliation Statement (BRS) interview questions to help accounting students and job...

Why Certified Corporate Accounting Is in...

Why Certified Corporate Accounting Is in High Demand comes down to industry needs for job-ready professionals with practical skill...

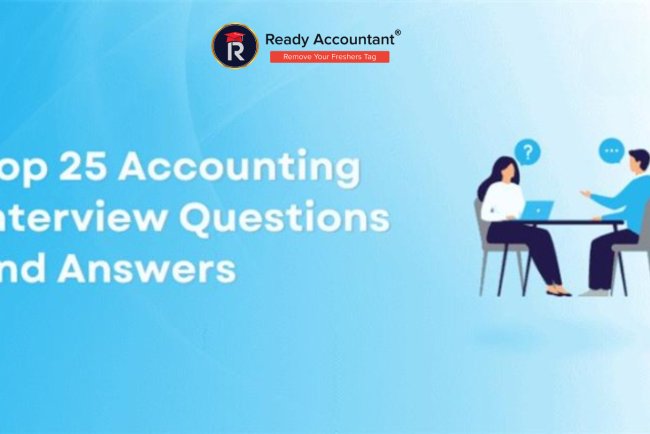

Top 25 Accounting Interview Questions an...

This guide on Top 25 Accounting Interview Questions and Answers 2026 covers essential accounting fundamentals, practical concepts,...

TDS Entry in Tally with Practical Exampl...

This article explains TDS Entry in Tally with Practical Example in a simple and practical way. It covers TDS basics, ledger creati...

Build a Strong Career in Accounting & Ta...

Building a strong career in accounting and taxation offers long-term stability, consistent demand, and diverse job opportunities a...