Impact of RBI’s Policy Changes on Accountants & Tax Professionals

The Reserve Bank of India (RBI) shapes India’s economy through policies on interest rates, regulations, compliance, and digital payments like UPI. These changes affect accountants and tax professionals by altering financial reporting, tax filings, and compliance tasks. Accountants must update interest calculations and reports, while tax professionals handle GST, TDS, and foreign payment rules. Courses like Certified Corporate Accounting, SAP FICO, and Taxation (Income Tax & GST) help professionals adapt. RBI updates create opportunities in advisory services, compliance, and global careers, especially with trends like the Digital Rupee and stricter regulations. Continuous learning is key to thriving in this dynamic field.

The Reserve Bank of India (RBI) keeps India’s economy steady and growing. When the RBI makes new rules, it affects businesses, accountants, and tax professionals. These rules change how they prepare financial reports, file taxes, and follow laws.

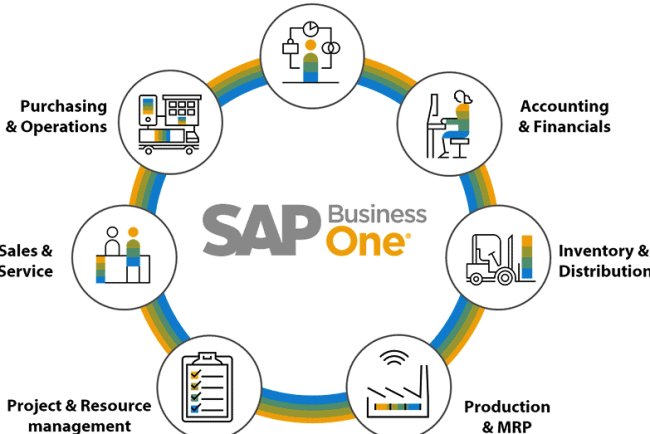

This article explains how RBI’s changes impact accountants and tax professionals in simple words. It also shows how students and professionals can prepare by learning courses like Certified Corporate Accounting, SAP FICO (Finance & Controlling), and Taxation (Income Tax & GST).

1. Why RBI’s Changes Are Important

The RBI controls key parts of India’s money system:

-

Monetary Policy: Sets interest rates like repo rate and cash reserve ratio.

-

Regulations: Makes rules for banks, finance companies, and digital payments.

-

Compliance: Sets standards for identity checks (KYC) and reporting.

-

Payments & Currency: Manages UPI, digital rupee, and foreign payments.

These changes affect businesses by changing loan costs and rules. For accountants and tax professionals, it means updating reports, tax filings, and advising clients.

2. How Accountants Are Affected

(a) Changes in Interest Rates

When RBI changes rates:

-

Loan and deposit costs change.

-

Accountants update interest calculations.

-

They adjust cash flow reports for clients with loans.

(b) New Reporting Rules

RBI updates how companies report finances. Accountants must:

-

Ensure reports are correct.

-

Follow RBI’s new formats.

-

Submit documents on time.

(c) Corporate Accounting

For those studying Certified Corporate Accounting, RBI changes are real-life lessons. For example, a higher Cash Reserve Ratio (CRR) changes how banks record reserves.

3. How Tax Professionals Are Affected

(a) Taxes on Bank Transactions

RBI changes impact taxes like:

-

Taxes on interest earned by people or companies.

-

GST on banking services.

-

TDS (tax deducted at source) on bank payments.

(b) Taxes on Digital Payments

With RBI promoting digital payments:

-

Tax professionals check GST on UPI and fintech services.

-

They ensure cross-border payments follow RBI’s foreign exchange rules.

(c) Bigger Advisory Role

Tax professionals now do more than file taxes. They:

-

Help businesses follow FEMA rules for overseas payments.

-

Assist with RBI’s Liberalised Remittance Scheme (LRS) reporting.

4. Case Study: Digital Payments & UPI

RBI’s push for UPI changes how accountants and tax experts work:

-

Accountants handle digital transactions and e-invoices.

-

Tax professionals manage GST for online businesses.

-

For SAP FICO learners, understanding how ERP systems follow RBI’s payment rules is key.

5. Skills to Handle RBI Changes

RBI rules change often, so professionals must keep learning:

-

Certified Corporate Accounting: Teaches how to adapt to RBI’s reporting rules.

-

SAP FICO (Finance & Controlling): Helps with automation and real-time reporting.

-

Taxation (Income Tax & GST): Prepares professionals for tax changes caused by RBI policies.

6. Opportunities from RBI Changes

RBI updates bring challenges but also opportunities:

-

Advisory Services: Businesses need accountants to explain RBI rules.

-

Compliance Help: Tax professionals ensure companies follow RBI norms.

-

Career Growth: Skills in Certified Corporate Accounting and SAP FICO are in high demand.

-

Global Careers: RBI’s alignment with global standards helps accountants with IFRS and SAP skills work worldwide.

7. Future Outlook

The future will bring bigger roles for accountants and tax professionals with:

-

The Digital Rupee (CBDC).

-

Stricter KYC and Anti-Money Laundering rules.

-

New fintech regulations.

This means:

-

Accountants will create automated reports to meet RBI standards.

-

Tax professionals will handle taxes for digital assets.

-

Students learning Certified Corporate Accounting, SAP FICO, and Taxation will lead the finance industry.

Conclusion

RBI’s policy changes strongly affect accountants and tax professionals. Each update changes how they report finances, file taxes, and follow rules. Instead of seeing these as problems, professionals should see them as chances to grow.

For students and professionals, courses like Certified Corporate Accounting, SAP FICO, and Taxation (Income Tax & GST) are the key to building a strong career in today’s finance world.

What's Your Reaction?