Bank Minimum Balance Charges & Penalties Explaine

Banks charge penalties (plus GST) if you don’t keep the required minimum balance in your account. The rule varies by account type and branch. Avoid charges by choosing zero-balance accounts, setting alerts, or linking deposits.

Keeping money in the bank is something almost everyone does — for safety, easy payments, and interest. But sometimes, people get surprised when their account balance suddenly goes down because of bank charges. One common reason is the minimum balance rule.

In this guide, we will explain Bank Minimum Balance Charges & Penalties Explained in simple words, and also share tips to avoid paying these charges.

What is Minimum Balance?

Minimum balance means the least amount of money you must keep in your bank account to avoid a penalty.

-

If your account balance goes below this limit, the bank will charge you a fee.

-

The amount you need to keep depends on the type of account and the location of the branch.

Example:

-

An urban branch might ask for ₹10,000 minimum balance.

-

A rural branch might only need ₹1,000.

Why Do Banks Ask for a Minimum Balance?

Banks need money in accounts to:

-

Cover the cost of maintaining accounts.

-

Keep accounts active and running.

-

Reduce the number of accounts that are not being used.

Bank Minimum Balance Charges & Penalties Explained

If you do not keep the required minimum balance, the bank charges you a penalty. This is called a non-maintenance fee.

How much they charge depends on:

-

Where the branch is (city, town, or village).

-

What type of account do you have (basic, premium, or current account)?

-

How often do you fail to keep the balance?

Example:

If your account needs ₹10,000 and you only have ₹7,000, the bank may charge ₹150–₹500 plus GST.

Minimum Balance Requirements in Some Banks (2025)

| Bank Name | Minimum Balance | Penalty for Not Maintaining |

|---|---|---|

| SBI | ₹3,000 (Urban) | ₹10–₹15 + GST per month |

| ICICI Bank | ₹10,000 (Urban) | ₹100–₹600 + GST per month |

| HDFC Bank | ₹10,000 (Urban) | ₹150–₹600 + GST per month |

| Axis Bank | ₹12,000 (Urban) | ₹150–₹600 + GST per month |

| PNB | ₹2,000 (Urban) | ₹10–₹200 + GST per month |

(These amounts can change based on account type and location.)

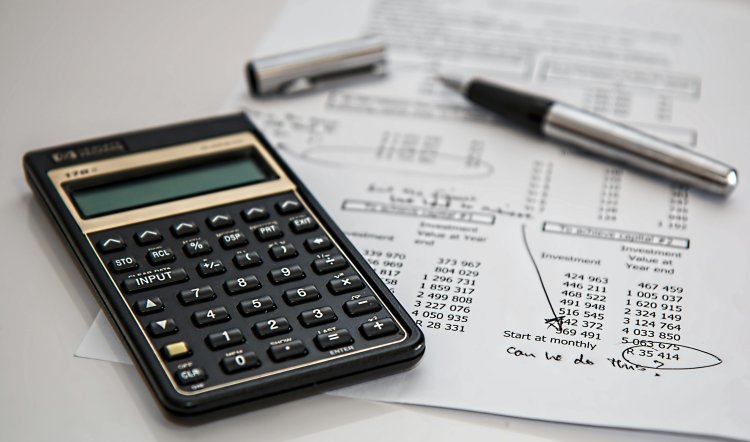

How Do Banks Calculate the Penalty?

Most banks use the Monthly Average Balance (MAB) or the Quarterly Average Balance (QAB) to decide the penalty.

Monthly Average Balance formula:

If this average is less than what the bank needs, you pay a penalty.

Why Should You Avoid These Penalties?

Even if the penalty is small, it can add up over time. For businesses, especially those using SAP FICO (Finance & Controlling) for accounting, such charges can disturb cash flow planning.

Problems from repeated penalties:

-

Your account balance gets lower without you noticing.

-

It can affect your relationship with the bank.

-

In some cases, the bank may close your account.

How to Avoid Minimum Balance Charges

-

Choose a Zero-Balance Account – These accounts do not need a minimum balance.

-

Set Balance Alerts – Use your bank’s app or SMS alerts to get notified when your balance is low.

-

Automate Money Transfers – Transfer money from another account when your balance is low.

-

Link a Fixed Deposit – Some banks let you link an FD to meet the balance rule.

-

Pick the Right Branch – Rural or semi-urban branches usually have lower requirements.

GST on Bank Penalties

Bank penalties are not just the fee — GST is added too.

Example:

If the penalty is ₹300 and GST is 18%, you will pay ₹354 in total.

This is part of the Taxation (Income Tax & GST) rules in India.

Learning More About Banking in Professional Courses

If you are building a career in banking or finance, knowing rules like Bank Minimum Balance Charges & Penalties Explained is important.

Popular courses that teach this include:

-

Certified Corporate Accounting – Covers all accounting basics, including banking operations.

-

SAP FICO (Finance & Controlling) – Helps track financial transactions in businesses.

-

Taxation (Income Tax & GST) – Explains tax rules on bank services and charges.

If you are looking for training, the best accounting institute in Kolkata offers these courses with practical examples and industry-level knowledge.

Case Study: ICICI Bank Urban Branch

Let’s say:

-

Required MAB = ₹10,000

-

Actual MAB = ₹7,000

-

Shortfall = ₹3,000

Penalty Calculation:

Penalty ₹200 + GST (18%) = ₹236

If this happens for 6 months, you lose ₹1,416 — which is enough to keep your account active for one month.

Future of Minimum Balance Rules

The RBI is encouraging banks to be more customer-friendly. In the future, we may see:

-

Lower balance requirements.

-

More zero-balance accounts.

-

Flexible rules for online-only accounts.

Some digital banks already have no penalty policies to attract younger customers.

Final Words

Knowing Bank Minimum Balance Charges & Penalties Explained helps you protect your money and avoid unnecessary fees. Keeping the required balance is not just about following bank rules — it is about developing good money habits.

For students and professionals, especially those learning Certified Corporate Accounting, SAP FICO (Finance & Controlling), and Taxation (Income Tax & GST), understanding these rules is a valuable skill. And if you want the right training, the best accounting institute in Kolkata can give you the practical knowledge you need to succeed

What's Your Reaction?