25 Important BRS Questions For Interview Preparation

This blog covers the 25 most important Bank Reconciliation Statement (BRS) interview questions to help accounting students and job seekers prepare confidently. It explains the meaning, purpose, and process of BRS, along with common differences between cash book and passbook balances. The questions range from basic concepts to practical and advanced interview-level topics frequently asked by employers. Understanding BRS is essential for roles in accounting, taxation, and finance. Students who complete an Accounting Course, Taxation Course, or GST Course gain strong practical knowledge of bank reconciliation, which is highly valued in interviews and real job responsibilities in the accounting field.

Bank Reconciliation Statement (BRS) is one of the most frequently asked topics in accounting interviews. Whether you are a fresher or an experienced candidate, interviewers often test your practical understanding of BRS because it reflects your knowledge of bank transactions, accuracy, and attention to detail. If you are preparing for an accounting role or have completed an Certified Corporate Accounting Course, this guide will help you revise the most important BRS interview questions and answers.

What is a Bank Reconciliation Statement?

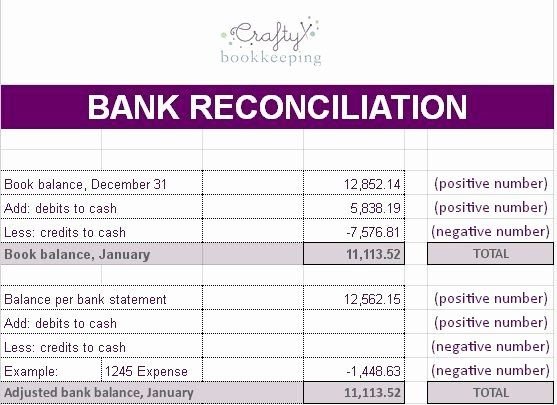

A Bank Reconciliation Statement is a statement prepared to reconcile the difference between the bank balance as per the company’s cash book and the bank statement (passbook). Differences arise due to timing issues, errors, or transactions recorded in only one book.

Interviewers ask BRS questions to check:

-

Practical accounting knowledge

-

Understanding of banking transactions

-

Accuracy and analytical skills

Let’s go through the 25 important BRS interview questions.

25 Important BRS Interview Questions

Basic-Level Questions

1. What is a Bank Reconciliation Statement?

A BRS is prepared to reconcile the cash book balance with the bank statement balance by identifying and adjusting differences.

2. Why is BRS prepared?

It is prepared to find differences between bank and book balances and ensure accuracy in financial records.

3. When is BRS usually prepared?

It is generally prepared at the end of every month.

4. What are the main causes of differences in BRS?

-

Cheques issued but not presented

-

Cheques deposited but not cleared

-

Bank charges

-

Interest credited by bank

-

Direct deposits

-

Errors

5. Is BRS part of the double-entry system?

No, BRS is a statement, not an account. It does not form part of the double-entry system.

Conceptual Questions

6. What is the difference between cash book balance and passbook balance?

Cash book balance is maintained by the company, while passbook balance is maintained by the bank.

7. What happens when a cheque is issued but not presented?

The cash book balance will be less than the passbook balance.

8. What happens when a cheque is deposited but not cleared?

The cash book balance will be more than the passbook balance.

9. How do bank charges affect BRS?

Bank charges reduce the bank balance but may not be recorded in the cash book until later.

10. How does interest credited by bank affect BRS?

Interest increases the bank balance but may not yet be recorded in the cash book.

Practical Questions

11. What is overdraft in BRS?

Overdraft means the bank balance is negative. It appears as a credit balance in the cash book.

12. How do you start preparing a BRS?

Start with either the cash book balance or passbook balance and adjust for differences.

13. What is a favourable balance?

When bank balance is positive.

14. What is an unfavourable balance?

When the account is overdrawn (negative balance).

15. What are direct deposits by customers?

Amounts directly deposited into the bank by customers without the company’s immediate knowledge.

Error-Based Questions

16. What if a cheque is recorded twice in the cash book?

It will create a difference that needs to be adjusted in BRS.

17. What if bank wrongly debits an amount?

It will reduce the passbook balance and must be adjusted in BRS.

18. What if a cheque amount is recorded wrongly?

The error must be identified and corrected while preparing BRS.

19. Can BRS detect fraud?

Yes, it helps identify unauthorized transactions or errors.

20. What if both balances match?

No BRS is required, but it’s still good practice to prepare one for verification.

Advanced & Interview-Focused Questions

21. Which balance is considered correct in BRS?

Neither is automatically correct. BRS helps identify which balance needs correction.

22. How does BRS help in auditing?

It verifies bank transactions and ensures accuracy of financial records.

23. Can BRS be prepared using accounting software?

Yes, software like Tally or ERP systems can generate BRS automatically.

24. How often should BRS be prepared in a company?

Monthly or even weekly in large organizations.

25. What skills are required to prepare BRS?

-

Attention to detail

-

Knowledge of accounting entries

-

Understanding of banking transactions

-

Excel or accounting software skills

Importance of BRS in Interviews

BRS is one of the most practical topics in accounting interviews. Interviewers use it to judge whether you can handle real financial records. If you are planning a career in accounts, finance, or taxation, mastering BRS is essential.

Students who complete an Accounting Course gain strong practical knowledge of BRS preparation. Those enrolled in a Taxation Course or GST Course also need BRS knowledge because accurate bank reconciliation is crucial for tax filing and GST returns.

For example:

-

GST payments are made through bank transactions

-

TDS and tax payments must match bank records

-

Auditors often check BRS for verification

This is why most job-oriented Accounting Course, Taxation Course, and GST Course programs include BRS training with practical examples.

Tips to Prepare for BRS Interview Questions

-

Practice numerical problems regularly

-

Understand the logic behind adjustments

-

Learn common differences between cash book and passbook

-

Practice in Excel and accounting software

-

Revise journal entries related to bank transactions

Mock interviews and practical assignments in an Accounting Course can help you gain confidence.

Conclusion

Bank Reconciliation Statement is a must-know topic for every accounting job interview. Whether you are a fresher or experienced candidate, interviewers expect you to understand BRS concepts and solve practical questions.

What's Your Reaction?