Tag: GST Course

Tax Evasion & Cash Transaction Rules in 2026: Late...

The Income Tax Cash Rules 2026 impose strict limits on cash transactions to curb tax evasion and promote transparency. Under the C...

GST on Milk and Dairy Products – GST Rate

GST on milk and dairy products varies depending on the type and level of processing. The GST rate on milk in India is generally 0%...

50 Important Cash Book Questions & Answers For Int...

This blog covers 50 important cash book interview questions and answers to help accounting students and job seekers prepare effect...

Top Accounting Skills You Need in 2026 to Get Hire...

To get hired faster in 2026, accountants need more than just a degree—they need practical, job-ready skills. Strong fundamentals i...

How Ready Accountant Makes You Job-Ready in 3–6 Mo...

Ready Accountant helps students become job-ready in just 3–6 months through practical, industry-focused training. Its Certified Co...

AIS & Form 26AS Explained: Why They Matter for ITR...

AIS (Annual Information Statement) and Form 26AS are essential documents for accurate ITR filing in India. AIS provides a detailed...

Top Tax Saving Strategies for Salaried Employees i...

Salaried employees in 2026 can reduce their tax burden by choosing the right tax regime, maximizing Section 80C deductions, and in...

How to Check Your IRS Tax Refund Status (Step-by-S...

An Accounting, Taxation, and GST course equips students with practical skills needed for modern finance and compliance roles. It c...

Career Opportunities After 12th Commerce: Complete...

Career opportunities after 12th commerce are vast and diverse, ranging from traditional degrees to skill-based professional course...

Excel Lookup and Reference Functions: A Step-By-St...

Excel lookup and reference functions help users quickly find and manage data in spreadsheets. Functions like VLOOKUP, HLOOKUP, XLO...

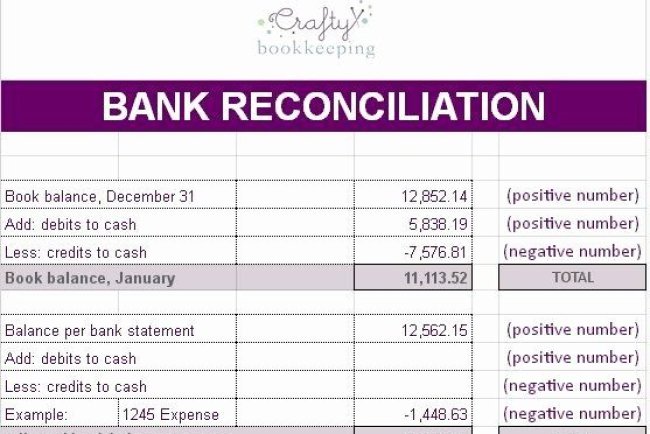

25 Important BRS Questions For Interview Preparati...

This blog covers the 25 most important Bank Reconciliation Statement (BRS) interview questions to help accounting students and job...

What is Flash Fill In Excel?

Flash Fill in Excel is a powerful feature that helps users automatically fill in values based on patterns identified from adjacent...

Everything You Need to Know About IPOs

This comprehensive guide explains everything you need to know about IPOs in 2025—from understanding the IPO full form (Initial Pub...

Certified Corporate Accounting Course: Admission O...

The Certified Corporate Accounting Course is a comprehensive program designed to equip learners with practical skills and industry...

Best GST Training Institutes in Kolkata: Learn fro...

Finding the best GST training institutes is essential for individuals and professionals aiming to build a strong foundation in Goo...

TOP Secret TallyPrime Shortcut Keys for Accountant...

This blog post reveals powerful TallyPrime shortcut keys every accountant and finance student should know. These shortcuts help sp...

Top 20 SAP FICO Shortcut Keys for Faster Financial...

The "Top 20 SAP FICO Shortcut Keys" provide quick access to commonly used functions within the SAP FICO (Financial Accounting and ...

Top Essential Topics Covered In GST Courses

GST courses are designed to equip learners with comprehensive knowledge of the Goods and Services Tax system in India. Key topics ...

How to Calculate Percentage in Excel? A Step-by-St...

To calculate percentages in Excel, use a simple formula. The basic method is: =(Part/Total)*100. For example, if you want to find ...

What is Data Security in Tally ERP 9?

Tally ERP 9 ensures robust data security by offering multiple layers of protection to safeguard sensitive business information. It...

Top 20 GST Interview Questions and Answers

The topic "Top 20 GST Interview Questions and Answers" serves as a valuable resource for candidates preparing for interviews in th...

Best Career Option in Finance after 10th:

After completing the 10th grade, students interested in finance can explore several promising professional paths. one of the best ...

Top 10 Project Topics for Commerce and B.com Stud...

Choosing the right project topic is crucial for Commerce and B.Com students to enhance their academic understanding and career pro...

Best Certificate Courses after 12th:

After completing 12th grade, choosing the right certificate course can form your career correctly. The first-rate certificate cour...

New Rules for RBI From May 1, 2025.

Effective May 1, 2025, the Reserve Bank of India (RBI) has carried out several regulatory modifications impacting banking operatio...

Top 10 Journal Entry Mistakes to Avoid in Intervie...

This article highlights the Top 10 Journal Entry Mistakes to Avoid in Interviews for accounting professionals and students. Common...

Top 5 Corporate Accounting Questions and Answers

Corporate Accounting plays a crucial role in managing a company's financial health. in this guide at the Top 5 Corporate Accountin...

Top Career Options in Commerce in India

Commerce offers diverse and rewarding career paths in India, catering to college students with interests in finance, business, law...

Job-Oriented Courses in Corporate Accounting in In...

A Corporate Accounting course equip students and professionals with practical skills essential for careers in finance and accounti...

Trial Balance in Tally ERP 9: A complete guide

A Trial Balance in Tally ERP is a crucial financial report that displays the summary of all ledger balances for a selected period....

Inventory Valuation Process in Accounting: A Compl...

Inventory valuation in Accounting refers to the method used to assign an economic value to an agency's inventory at the end of an ...

Best Accountant Training Program and Job Opportuni...

The nice Accountant education program and job opportunities in 2025 highlight the developing demand for skilled accounting profess...

GST Filing procedure: Step-by-Step guide

The GST filing procedure is a mandatory compliance technique for all registered taxpayers under the Goods and Services Tax (GST) s...

ITR filing last Date FY 2024-25 (AY 2025-26): A co...

The ITR filing final date for FY 2024-25 (AY 2025-26) is an important deadline for taxpayers in India. For most character taxpayer...

CA vs CMA: career Scope, salary & role comparison

CA (Chartered Accountant) and CMA (Cost and Management Accountant) are prestigious accounting professions in India, but they serve...

Tips and Tricks to Speed Up Your Work in Tally

Speeding up your work in Tally requires smart usage of shortcuts and efficient information control. mastering keyboard shortcuts l...

Choosing the perfect Taxation course: Things to Co...

Choosing the right taxation course is vital for building a successful career in finance or accounting. start by assessing your car...

Types of Depreciation Entry in Accounting

Depreciation is systematically allocating a fixed asset’s fee over its useful life. In accounting, depreciation entries ensure cor...

Analyze GST and Tax Filing Through a Taxation Cour...

A taxation course provides in-depth information on GST and tax filing, equipping experts with the talents to address tax complianc...

Place of supply in GST: A comprehensive guide

Place of supply in GST refers to the area where a transaction is deemed to occur for tax functions. It determines whether or not a...

Top reasons to Take a Taxation course

A taxation course equips individuals with essential knowledge of tax laws, compliance, and economic making plans. it's miles usefu...

What is BRS in Accounting?

A bank Reconciliation statement (BRS) is a financial document that reconciles the differences between an employer’s cash book and ...

How a Taxation course can help you become a Tax co...

A taxation course equips individuals with in-depth knowledge of tax laws, compliance procedures, and financial regulations, laying...

How to become an accounts manager? Roles and respo...

Becoming an accounts manager requires a combination of education, experience, and capabilities in finance and control. A bachelor’...

Tally With GST Course: The Perfect Combo For Accou...

A Tally with GST course is an essential combination for aspiring and professional accountants looking to beautify their knowledge ...

Income Tax Slabs and Key changes in Union budget 2...

Taxation has long been the primary method for governments worldwide to generate revenue and ensure easy governance, and India isn'...

How to file GSTR-1:

GSTR-1 is a monthly or quarterly return that organizations registered underneath GST should record to report their outward compone...

Top 5 Excel Hacks to save time on data entry

Mastering Excel hacks can notably streamline data access, saving time and improving productivity. Key hints encompass the usage of...

The economic vision of Netaji Subhash Chandra Bose

Netaji Subhash Chandra Bose was a visionary leader who espoused an autonomous and inclusive economic model for India. His vision i...

Discover the Best Corporate Accounting Course for ...

Find the quality corporate accounting route for professionals looking to improve their skills in best accounting practices. these ...